EMP Trust provides professional support to your in-house I-9 audits.

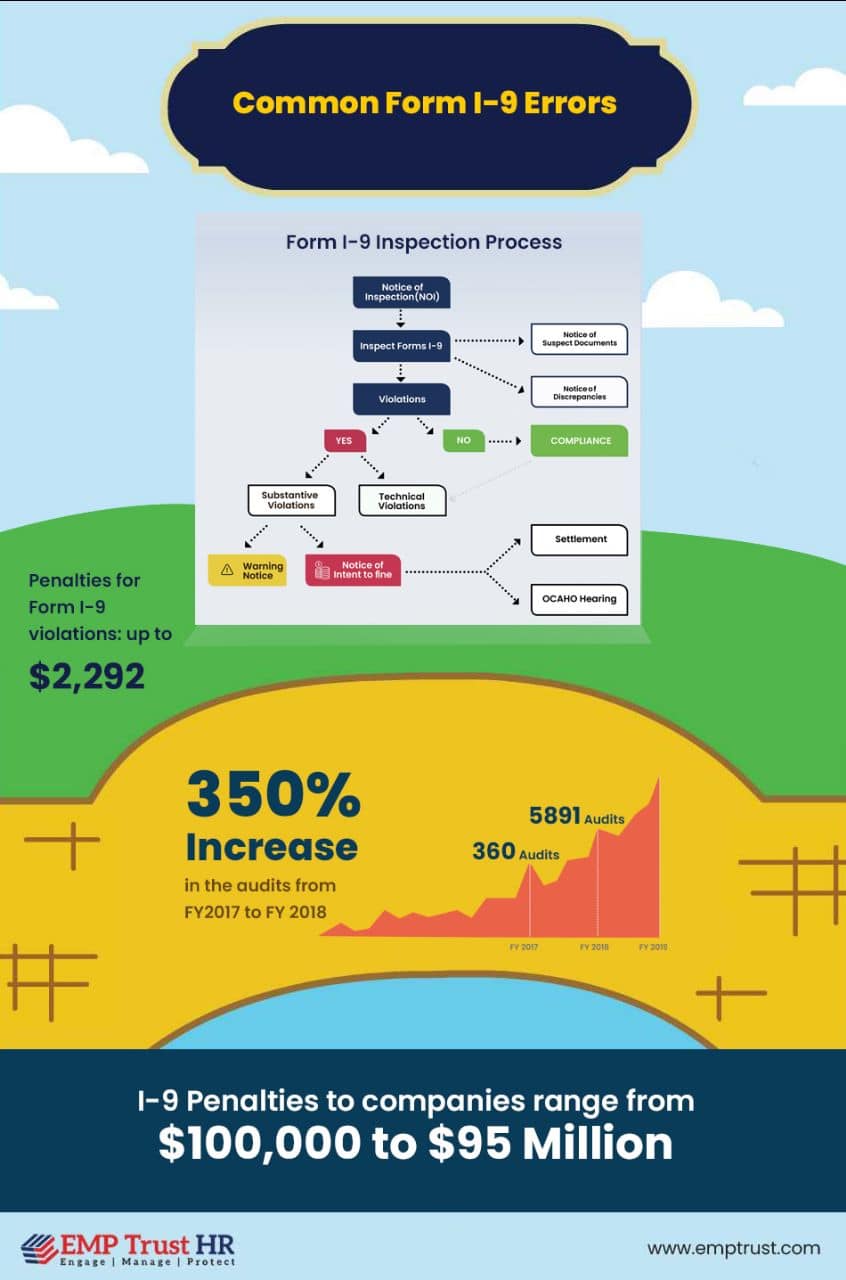

In the Fiscal Year 2019, the Immigration and Customs Enforcement (ICE) carried out over 6,400 Form I-9 audits. This led to organizations being fined millions of dollars.

Typical errors made when filling out Form I-9:

Even minor errors on your I-9 Forms can lead to substantial penalties. Fines can range from a minimum of $224 to a maximum of $22,927 per violation for each I-9 form.

- Incomplete Forms: There could be instances where employers overlook filling in the candidate’s name in section-2 or neglect to complete the section pertaining to the preparer/translator.

- Missed Deadlines: There are instances where employers do not manage to fill out the Form I-9 within the first 3 business days of employment.

- Signature & Date: The form may be rendered invalid if the employer or employee overlooks signing it after completion.

- Incorrect I-9 Version: It’s crucial to use the correct version of Form I-9, which corresponds with the employee’s hire date, just as it’s important to complete the form.

- Incorrect Supporting Documents: Employers might overlook verifying the authenticity of the provided supporting documents and could potentially accept incorrect or false documents.

Safeguarding Against ICE Audits & Penalties:

In-house I-9 Reviews: Internal audits play a pivotal role in ensuring adherence to I-9 requirements. They offer an opportunity for a thorough review of the forms, detection of any missing I-9s, and identification of possible mistakes. Although not legally mandated, employers might opt for internal audits to maintain continuous compliance with the employer sanctions clause of the INA.

Employers can decide to examine all Forms I-9 or select a subset of them based on neutral and non-discriminatory criteria for review.

Who is Eligible to Perform this Task?

Employers have the ability to carry out internal I-9 audits by adhering to the procedures outlined by ICE, and EMP Trust can provide assistance in this process.